“Pharmacist to buy”

Why Dis-chem is on my radar:

Dis-chem has a 52-week high of R 34.99 and a 52-week low of R23.40. Dis-chem shares are currently trading at R22.10 (at time of writing) setting a new 52-week low. This is where I like to buy shares since it offers a margin of safety.

Dis-chem is probably still overvalued:

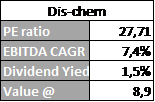

I am a follower of Peter Lynch and Warren Buffet and my investing style is somewhere in-between depending on the company and market conditions. Comparing the P/E and the 4-year Annualized growth rate of Dis-chem’s EBITDA plus it’s dividend yield, displayed in the figure below, we can see Dis-Chem is probably overvalued. The reason behind using EBITDA growth rate is because this rate is less subject to management manipulations and distortions from one-time corporate events. Dis-chem seems to be fairly valued at 8.9 times earnings and is currently trading at 25.79. Just as any other valuation methods Lynch Fair Value has its limitations. It tends to underestimate slower growing companies and overestimate fast growing companies. And it assumes that the company will grow in the future as fast as it did in the past, which is usually not the case.

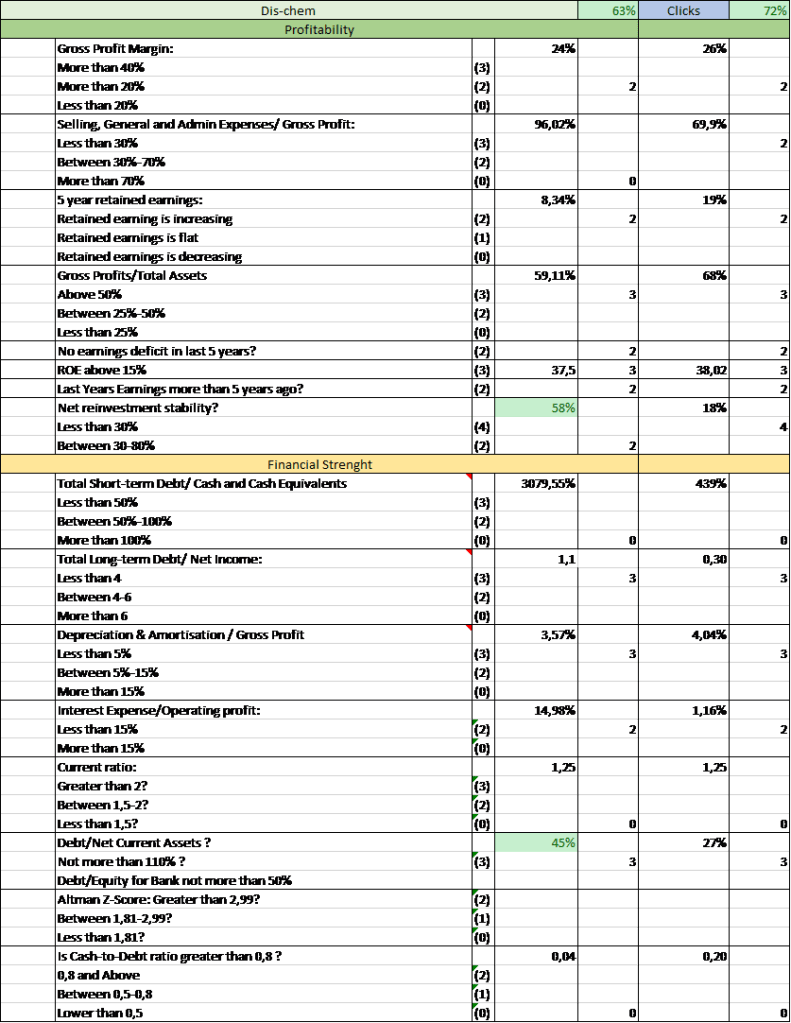

Does Clicks have a competitive advantage over Dis-chem?

Dis-chem scored 63% and Clicks 72%. Clicks have the real competitive advantage comparing its financial strength to Dis-Chem’s.

On 7 July 2019 BusinessTech release an article “Pharmacy price war 2019” this article compares the pricing of Dis-chem vs Clicks vs Checkers vs Pick n Pay vs Spar. BusinessTech shopped around for 9 common OTC items at these stores to find which stores offers the lowest prices, as shown below Dis-Chem clearly has a price advantage over its closest competitor Clicks and a price advantage over all major competitors in the market.

Finally, we will compare average operating profits per store for Dis-Chem and Clicks:

At the end of February 2019 Dis-Chem’s footprint totalled 149 stores. They made an Operating profit of R1,217,866,000 at year end February 2019. This is an average Operating Profit of R8,173,597.32 per store. Comparing this average operating profit to Clicks: The Clicks Group has over 853 stores with an operating profit of R 2,040,394,000 this equals an average operating profit per store of R 2,392,021.10. Dis-chem clearly has a pricing advantage over Clicks as well as a higher Operating Profit per store.

Why Dis-chem should be an addition to your portfolio:

Even though Dis-Chem trades at a PEG ratio of 3.11. It’s the business model I want to invest in, and I am prepared to pay a premium for it. Dis-Chem Group has given some insight into how it deliberately cannibalises its own stores in an area in order to grow the top- and bottom-line from the node overall.

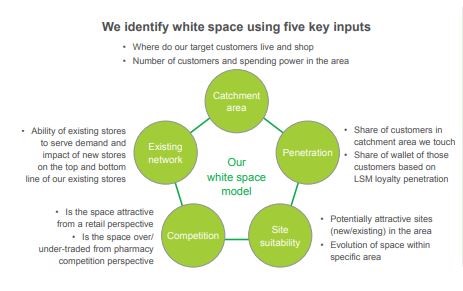

In a presentation accompanying its results, the Dis-Chem Group details how it considers store expansion. For its ‘white space’ model, it uses five inputs as shown in the diagram below:

Once this analysis is complete, it then asks three questions:

- Is there an opportunity for additional Dis-Chem presence (and incremental performance)?

- Where in the areas should a new store be established? Will we build or acquire, and what format will be deployed?

- How can fixed costs be managed to optimise store-level EBITDA (earnings before interest, taxes, depreciation, and amortisation) given top-line implications on existing locations?

In the presentation, it shares how it approached the situation in three different catchment areas. Let’s have a look at Sandton, George and Greenstone:

In Sandton, where it already had a store at Benmore Gardens, a site in Sandton City became available (space vacated by Stuttafords). Additionally, a medical centre opened in Morningside. Dis-Chem opened stores at both locations. Both additional stores appeal is obvious, having a store in a major regional mall and the store in Morningside that will benefit from the medical centre environment. Dis-Chem describe the Sandton node as extremely attractive and significantly under penetrated with only 8 other pharmacies within the node.

The node revenue has been flat since 2016 (with less than 5% top line growth at Benmore), it has nearly doubled revenue across the node to R416 million a year from the R211 million from just Benmore in its 2017 financial year. By next year, revenue is expected to increase to 475 million across the three stores. This hasn’t come at tremendous top line cost to the Benmore store, with revenue in that outlet retreating to roughly 180 million.

The alternative, of course, was to keep trading from one store, with other competitors potentially stepping in.

Dis-chem says it is “managing costs across the node by redeploying staff across the three stores”.

This model used by Dis-chem to cannibalize a single store’s revenue to increase the top-line is brilliant, this model increases Dis-chem’s footprint by decreasing competitor presence in the specific node.

The Greenstone node is another example of this business model, where they opened two new stores, decreasing the Greenstone store’s revenue to about R 170 million from R 200 million but increasing the top-line revenue to R 318 million.

In the George Node, Dis-chem decided to take the acquisition route. Competitor presence is high with 23 other pharmacies. This caused the node to be over traded on the pharmacy side. Because of this, Dis-chem purchased an independent pharmacy and expect to increase the George node’s revenue by 46 million in 2020.

With this said, I recommend a long buy and hold strategy for Dis-chem.